In today’s digital economy, Real-Time Payments (RTP) have emerged as a groundbreaking solution to meet the growing demand for instant financial transactions. RTP technology allows businesses to process payments within seconds, enhancing financial efficiency and cash flow like never before. This innovative payment processing system is revolutionizing B2B payments, enabling organizations to fulfill obligations promptly and mitigate risks associated with delays. By integrating real-time capabilities into their financial infrastructure, companies can not only streamline their operations but also significantly reduce transaction costs. As we delve deeper into the potential of RTP, it becomes clear that embracing this technology is a critical step for businesses aiming to thrive in an increasingly competitive marketplace.

Also known as instant payment systems, Real-Time Payments represent a significant shift in how transactions are conducted. These systems facilitate immediate money transfers, ultimately allowing organizations to optimize their payment processing methods and boost operational efficiency. By leveraging emerging technologies within their financial infrastructure, businesses can respond to market demands swiftly, ensuring they remain competitive in the fast-evolving financial landscape. As we explore the latest developments in this space, it’s essential to appreciate how these instant transaction capabilities are reshaping the future of financial exchanges.

Enhancing Financial Efficiency with Real-Time Payments (RTP)

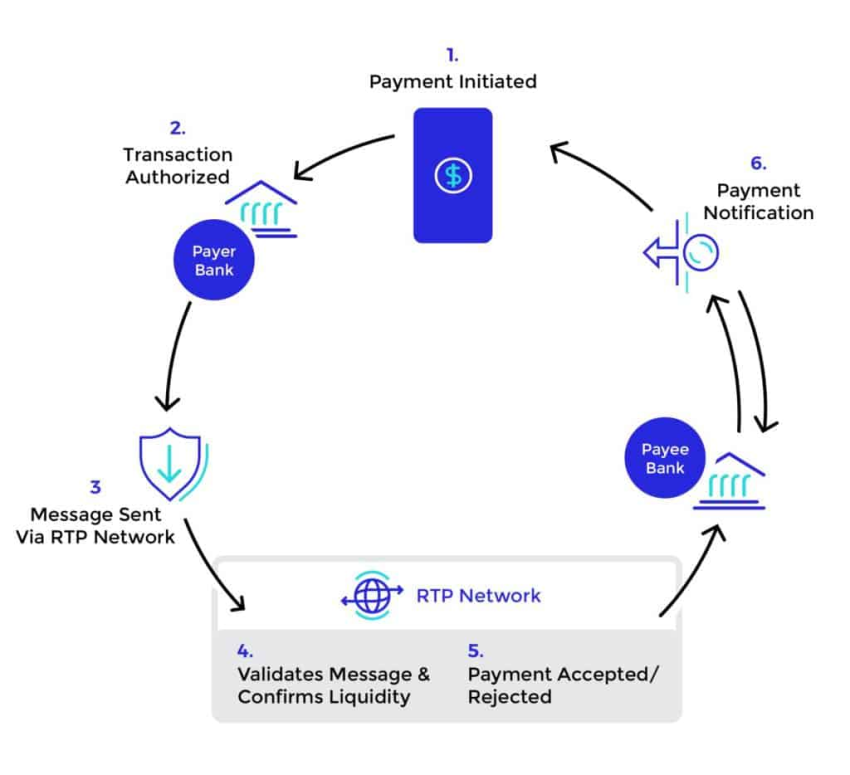

In an era where swift transactions are critical for business success, Real-Time Payments (RTP) redefine how organizations approach financial efficiency. By enabling instant processing, RTP technology eliminates long waiting periods associated with traditional banking methods. This immediacy facilitates improved cash management, allowing businesses to not only access their funds promptly but also make more strategic financial decisions. As market competition increases, organizations that leverage RTP stand to significantly enhance their financial efficiency compared to those adhering to slower payment processes.

Furthermore, the financial infrastructure underlying RTP systems is designed to support high transaction volumes seamlessly. With the advent of Instant Bank Connection, businesses can automate their payment processing, minimizing the manual effort involved in ACH setups. Such automation not only encourages quicker settlement times but also reduces operational costs associated with payment errors and discrepancies. By prioritizing RTP, businesses can focus on core activities while ensuring that their financial operations remain agile and responsive to market demands.

The Future of B2B Payments: RTP as a Game-Changer

The landscape of B2B payments is rapidly transforming, with Real-Time Payments emerging as a crucial factor in driving this change. Unlike traditional methods that can hinder cash flow and create operational bottlenecks, RTP allows transactions to be executed within seconds. This is particularly beneficial for businesses that operate on tight cash flow margins, enabling them to meet obligations without delay, increase transaction volume, and ultimately enhance profit margins. As industries evolve, the adoption of RTP will likely become a standard for financial interactions among businesses.

Emerging trends indicate that the integration of RTP technology in B2B payments will lead to a more interconnected financial ecosystem. As companies like Balance embed RTP capabilities into their payment solutions, businesses will benefit from faster, more efficient transaction processing. This reflects a broader shift towards a more digital and automated financial environment, paving the way for innovations like AI-driven financial analytics and real-time event streaming. As these trends unfold, embracing RTP will not only improve transaction efficiency but will also create new opportunities for businesses to optimize their payment strategies and remain competitive in a fast-evolving marketplace.

Frequently Asked Questions

What are the advantages of adopting Real-Time Payments (RTP) for businesses?

Real-Time Payments (RTP) offer several advantages for businesses, including accelerated cash flow, reduced operational costs, and increased customer satisfaction. With RTP, funds are transferred instantly, allowing businesses to manage their cash more effectively and invest in growth opportunities. Additionally, RTP systems minimize processing errors and costs associated with traditional payment methods, enhancing profitability. Ultimately, adopting RTP provides a competitive edge in a marketplace where efficiency is crucial.

How does RTP technology improve B2B payment processing?

RTP technology significantly enhances B2B payment processing by enabling immediate transaction capabilities, which streamline operations and optimize cash management. With innovations like Balance’s Instant Bank Connection, businesses can integrate RTP solutions that reduce processing costs and facilitate faster Automated Clearing House (ACH) payment setups. This advancement empowers organizations to fulfill their obligations promptly, improving overall financial efficiency and stability in their operations.

| Key Point | Details |

|---|---|

| Understanding RTP | RTP enables almost instantaneous payment processing, improving cash flow and reducing risks related to delayed payments. |

| Key Developments | 1. Balance’s Instant Bank Connection integrates RTP capabilities for faster ACH payments. 2. Emerging trends in finance include using AI and real-time event streaming to enhance RTP processes. 3. RTP adoption is vital for B2B payments to maintain efficiency. |

| RTP Adoption Growth | TrueLayer reported over $10 billion in transaction volumes within one month, indicating a strong preference for RTP systems in the market. |

| Benefits of RTP | Accelerated cash flow, reduced operational costs, increased customer satisfaction, and enhanced competitive edge in the market. |

Summary

Real-Time Payments are transforming the way businesses handle transactions in today’s fast-paced economic environment. As organizations seek to enhance operational efficiency, the adoption of RTP systems is proving to be crucial. Innovations such as Balance’s Instant Bank Connection are leading the way, enabling quicker transaction processes that significantly benefit cash flow and customer satisfaction. By embracing Real-Time Payments, businesses not only optimize their financial operations but also position themselves effectively within a competitive landscape, ensuring resilience and growth in an ever-evolving market.