Real-time payments (RTP) are ushering in a new era of financial transactions, fundamentally altering the way businesses and consumers interact with money. As the digital economy accelerates, the need for instant transfers has never been more critical, with recent RTP innovations leading the charge. The introduction of the FedNow system represents a significant milestone in this journey, promising to make real-time payment updates more accessible to a wider audience. However, this shift is not without its RTP challenges, as institutions grapple with legacy systems and security risks that accompany real-time transactions. Understanding these dynamics is essential for anyone looking to thrive in today’s fast-evolving payment landscape.

Instant payment solutions and immediate transaction frameworks are radically transforming the financial services sector. With an emphasis on speed and efficiency, these advancements provide unprecedented convenience for both businesses and customers. Technological breakthroughs in real-time transactions, such as those driven by the recently launched FedNow initiative, are crucial for fostering efficient payment experiences. However, the path to integrating these systems also presents notable hurdles that require careful navigation. Exploring these developments in real-time electronic payment facilitates deeper insights into the broader implications for the future of commerce.

Understanding Real-Time Payments and Their Impact on Financial Transactions

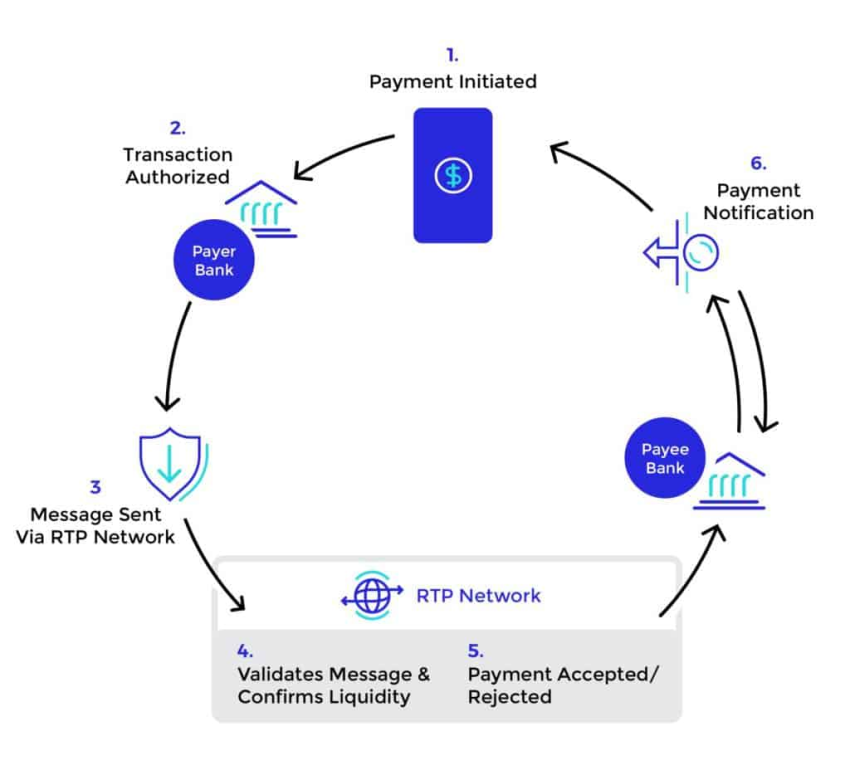

Real-time payments (RTP) have dramatically altered the way financial transactions occur today. With instant access to funds and immediate transaction confirmations, both consumers and businesses are benefiting from enhanced cash flow and improved financial management. RTP technologies enable transactions to be processed any time of the day or week, challenging traditional banking hours, thus supporting the growing demand for 24/7 availability. This shift not only streamlines operations for financial institutions but also enriches customer experiences, making RTP the preferred method for numerous industries.

Businesses utilizing real-time payments have reported a notable increase in customer satisfaction due to the immediacy of transactions. With customers expecting rapid processing times, the adoption of RTP allows companies to maintain competitiveness within their markets. Moreover, as RTP systems are increasingly integrated with accounting and financial software, they pave the way for unprecedented financial transparency and automatic record-keeping, which are critical for effective cash management and operational efficiency.

Navigating RTP Innovations: The Challenges and Opportunities Ahead

As the real-time payments landscape continues to evolve, innovation is a double-edged sword that brings both opportunities and challenges. While the FedNow system launches new avenues for institutions to adopt RTP, it also emphasizes the need for banks to upgrade their legacy systems to stay relevant. The fact that many institutions are still bogged down by outdated technology poses significant risks of losing market share to agile competitors. Thus, investing resources into modernizing infrastructure is not just advisable; it is essential for survival in this rapidly changing environment.

Additionally, the evolution of RTP brings forward various challenges such as integration costs and security risks. Establishing real-time payment systems often requires significant financial investment, particularly for smaller banks that might struggle with funding these upgrades. Security remains paramount, as the shorter transaction windows leave little room for fraud detection. Thus, financial institutions are urged to implement comprehensive security measures, including leveraging AI-driven solutions that enhance fraud detection while ensuring compliance with evolving regulatory standards.

Frequently Asked Questions

What are the latest real-time payment updates impacting businesses in 2023?

In 2023, the real-time payments landscape has seen substantial growth, with a 78% increase in RTP transactions. The introduction of the FedNow system by the Federal Reserve aims to enhance the adoption of real-time payments, especially among smaller financial institutions. Innovations in security, integration processes, and advanced technologies like AI for fraud detection are also transforming how businesses manage transactions, ensuring a more efficient and secure payment ecosystem.

What challenges do financial institutions face with real-time payments integration?

Financial institutions encounter several RTP challenges, including reliance on legacy systems that hinder modernization. Integration costs pose significant barriers, particularly for smaller banks, while the immediacy of real-time transactions raises security risks. As financial institutions strive for compliance and connectivity with networks like FedNow and The Clearing House’s RTP, they must also invest in advanced security measures to mitigate emerging threats.

| Key Point | Details |

|---|---|

| Introduction to RTP | RTP reshapes electronic payments, responding to consumer expectations for speed and efficiency. |

| Rapid Growth | RTP transactions in the U.S. see a 78% annual increase; expected to account for 56% of electronic payments by 2027. |

| Adoption Implications | Improves cash flow management and customer experiences. |

| Implementation Challenges | Legacy systems, high integration costs, and security risks hinder RTP adoption. |

| FedNow Initiative | FedNow’s launch in 2023 aims to bolster RTP adoption, especially among smaller institutions. |

| Global Innovations | Emerging markets and ISO 20022 standards are significant in RTP’s worldwide evolution. |

| Adoption Strategies | Financial institutions need to focus on business cases, incremental modernization, and client education. |

| Future Innovations | AI for fraud detection and advanced tech integration are key for advancing RTP. |

Summary

Real-time payments are fundamentally transforming the payment landscape, pushing the boundaries of what’s possible in transaction handling. The ongoing innovations in the RTP sector highlight how vital it is for businesses and financial institutions to keep pace. As technology continues to evolve, institutions that embrace real-time payment solutions not only enhance their operational efficiencies but also meet the growing consumer demand for instant financial transactions. The future of RTP is bright, but it requires a commitment from financial institutions to address challenges and harness the potential advancements on the horizon, thereby ensuring they remain competitive in an ever-changing marketplace.